GETTING TO KNOW THE GREEKS

The Options Greeks - AKA The Greeks help us to understand Options pricing and how the price of a stock can affect the value of your contracts in different ways.

Daily Habits

Practicing daily rituals is one of the best methods to achieve great focus. As you know, some of these trades demand a higher level of focus and attention than others. What you do every day defines who you are.

Supply And Demand Trading

Volume, Price Action, and Supply & Demand are all you need to identify high probability setups.

Trade Like A Robot

Many traders tend to lose big instead of winning small because we get caught up in the emotions associated with the trades. We stare at the P/L percent, and watch the dollar amounts very carefully. Though we entered the trade with a plan, now that we are in, we are considering making the plan a bit more flexible to suit our new needs.

Weekly Watchlist

Each and every Sunday we have a broad market overview, along with an analysis of some of the best technical setups ready to go for Monday morning. Come for the analysis, stay for the fun!

Pack It Up

Don’t shoot the messenger. The message is much needed. Also, this is coming from a place of compassion and empathy. Pack it up, b.

Never Look Back

Contrary to what popular songs of today might say, where they encourage you to look back at it, NEVER look back at trades you sold out of. Well, at least until a little later where emotions simmer down, and it will not mentally mess you up.

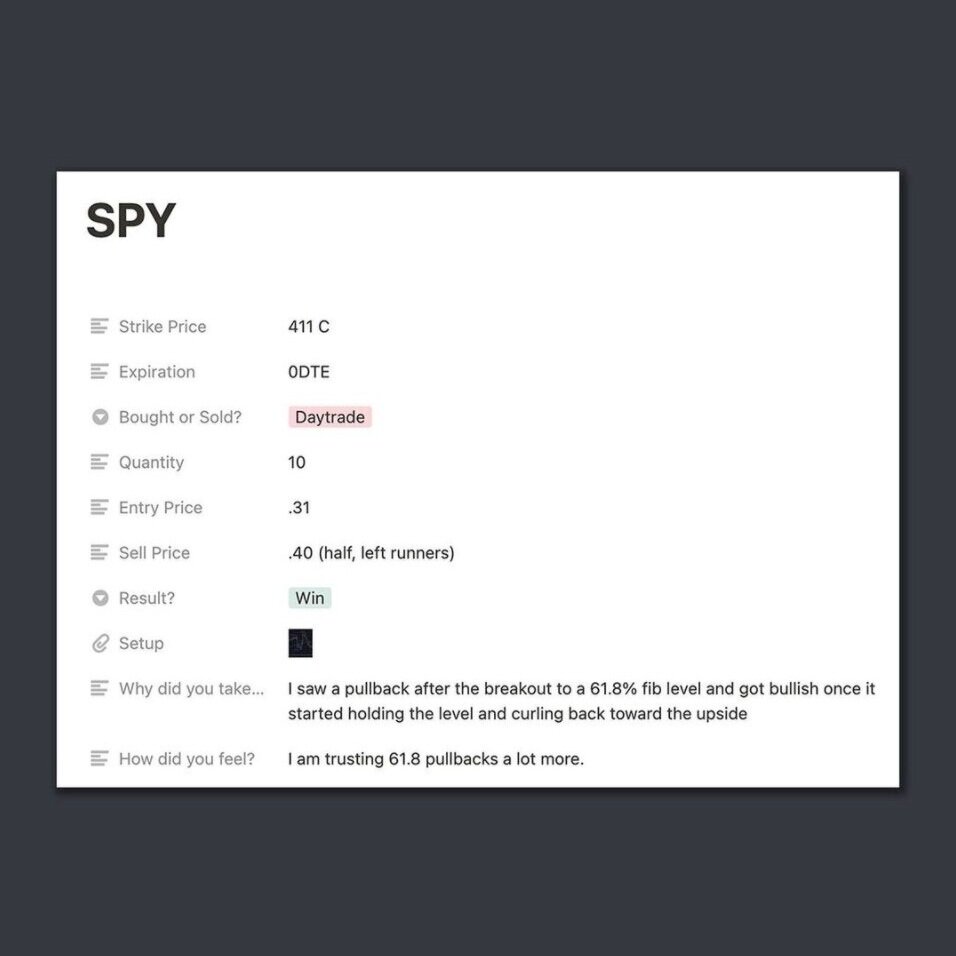

Use A Trade Journal

Journaling your trades is probably the LEAST sexy aspect of trading. Some probably actually treat it like a rubber and forego it entirely when they enter their position. They raw dog the trade, slip up, then wonder what happened and how they ended up here. Forgive all the imagery, but I want to drive the point home: You should be journaling your trades.

Earnings This Week

Here are some companies reporting earnings this week. Take a look to see which ones we have our eyes on.

Fighting FOMO

Everything that I have learned over my time as a trader, is obviously telling me “NOOOOOOO, DON’T CHASE IT!!” But here I am, still becoming overwhelmed with this feeling. This feeling is nothing new to just about everyone, but especially to traders. It is the fear of missing out, or what most just call FOMO.

Plan Your Trade, Trade Your Plan

“Go wherever the wind takes me”

This is something we’ve heard multiple times and is sometimes interpreted as being free-willed, adventurous and open minded. Some will even say it’s romantic. It is all of those and more, but in the right situation.

There Are No Shortcuts

Check out this quick post. This was a motivational message written in our private server by one of our members, STB, who blessed us with some words of wisdom to remind us of what path we are on.

Revenge Trading

“The actual charts and trading are the easy part. The mental and emotion part that’s tied to options trading — that’s the hard part.” This is a line I constantly try to keep in the forefront of my mind, especially when things just seem to not go my way.

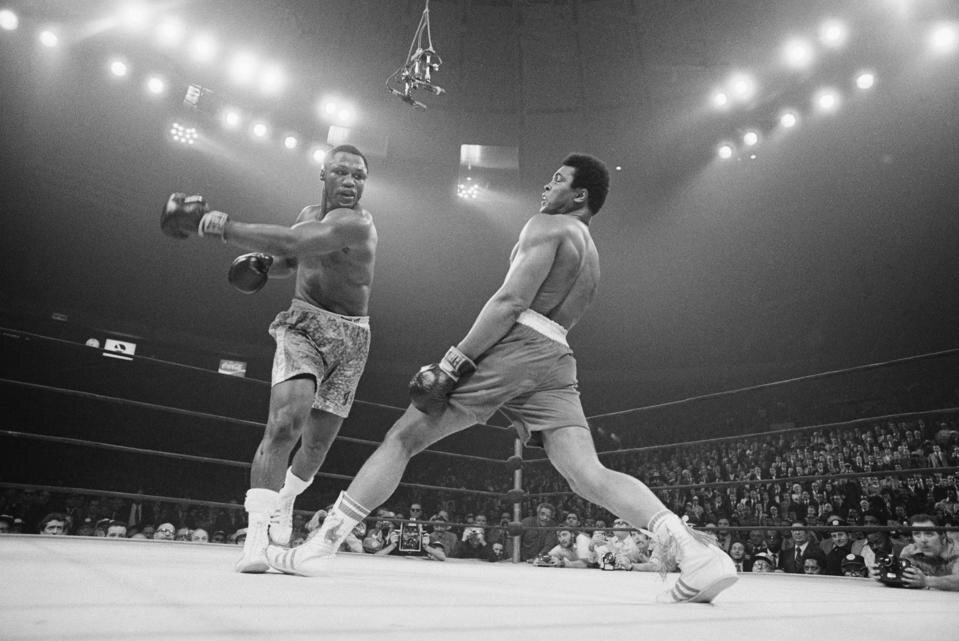

Float Like a Butterfly

With all of the uncertainty around interest rates, crypto falling back to where it came from, and FOMC meeting minutes being released, the market gave us very little direction today. Days like these require that you are fast on your feet. You know how the saying goes.

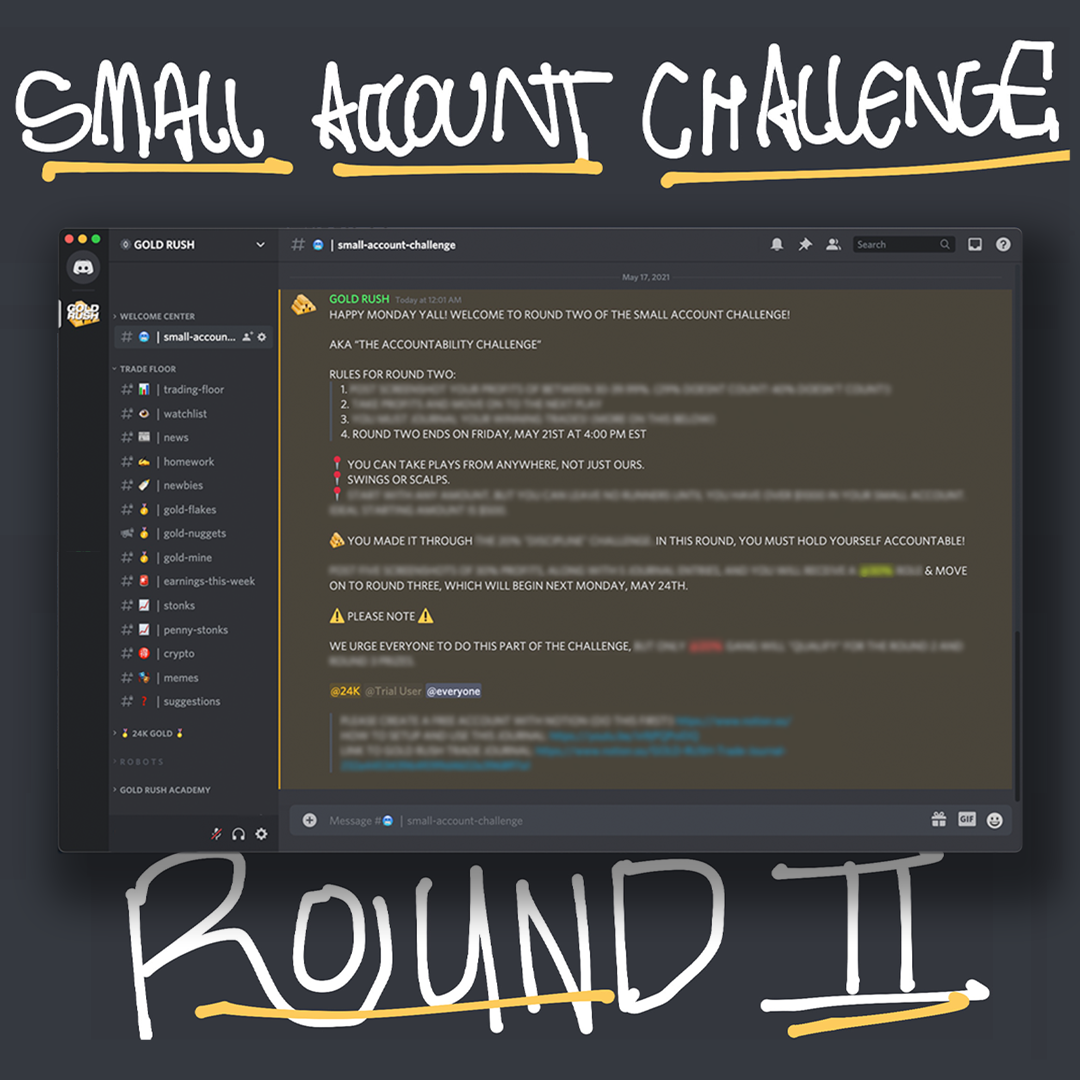

Small Account Challenge: Round Two

The Gold Rush Gang KILLED round one of our 𝘚𝘮𝘢𝘭𝘭 𝘈𝘤𝘤𝘰𝘶𝘯𝘵 𝘊𝘩𝘢𝘭𝘭𝘦𝘯𝘨𝘦 last week. We challenged our members to practice discipline in a choppy market and it paid off in a big way. Take a look at a few of the results.

Trading Confluence

Skilled traders take trades that have high-quality setups, based on a confluence of multiple factors that give a strong conviction to what direction the stock will move.

Algorithmic Trading

We unleashed some algos on our trading community today. We have activated some bots that report big money call and put buying, as well as darkpool activity.